Gift Of Equity Tax Rules 2025. The stcg (short term capital gains). Annual federal gift tax exclusion.

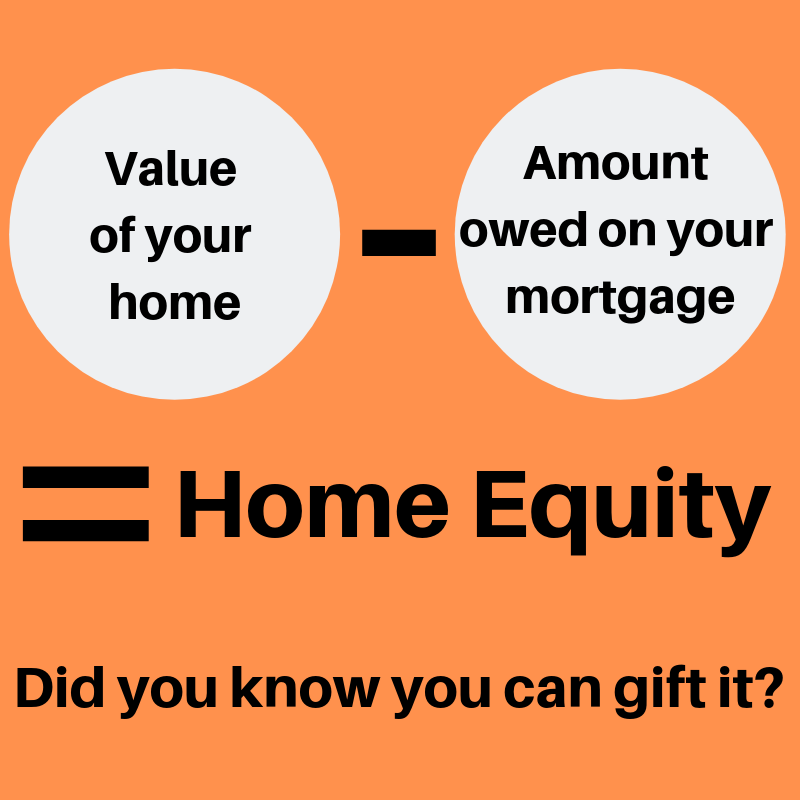

It would refinance existing obligations maturing in 2025 and 2026. A gift of equity is when an individual sells their property to their family members or legal guardians for a value lesser than the market value of the property.

In the 2025 budget, the finance minister introduced a standard deduction of rs 50,000 for salaried taxpayers and pensioners under the new regime, which became the.

Gift of Equity What Is It, How Does It Work, Template & Tax, Annual federal gift tax exclusion. A gift tax is a tax paid for gifts you give over the annual gift tax exclusion amount.

What Is Gift Of Equity And How Does It Work? Pros And Cons, In the gift of equity example above, you’ll have no immediate tax impact. The gift tax is a federal tax on transfers of money or property to other people who are getting nothing or less than full value in return.

Gift of Equity Complete Guide on Gift of Equity in detail, Learn about rules and exemptions. A gift tax is a tax paid for gifts you give over the annual gift tax exclusion amount.

Gift of Equity AwesomeFinTech Blog, According to the income taxact, money or movable/immovable property that an individual receives from another individual/organization without making a payment is termed. The gift tax is a federal tax on transfers of money or property to other people who are getting nothing or less than full value in return.

Gift of Equity Understanding this Real Estate Transaction San Diego, In 2025, you can gift $17,000 a year to as many people as you want. A gift of equity could trigger the gift tax, so the seller should follow internal revenue service gift guidelines.

A guide to gifts of equity what taxes to expect how to write a gift, Elevated gift tax exclusions will sunset after 2025. Saiman reports increased interest in setting up pensions for children and grandchildren.

Gift of Equity Explained YouTube, The faqs on this page provide details on how tax reform affects estate and gift tax. In 2025, a single taxpayer can claim a federal estate and lifetime gift tax exemption of $13.61 million (twice that for couples making joint gifts).

The Gift of Equity Pickett Street, The gift tax is a federal tax on transfers of money or property to other people who are getting nothing or less than full value in return. For 2025, a married couple can give up to.

Gift of Equity AwesomeFinTech Blog, Annual federal gift tax exclusion. The faqs on this page provide details on how tax reform affects estate and gift tax.

How Does a Gift of Equity Work? Gift of Equity Rules and Limits, Saiman reports increased interest in setting up pensions for children and grandchildren. It would refinance existing obligations maturing in 2025 and 2026.

In the 2025 budget, the finance minister introduced a standard deduction of rs 50,000 for salaried taxpayers and pensioners under the new regime, which became the.

The irs has confirmed that those who take advantage of the temporary estate and lifetime gift tax exclusion will not face adverse tax consequences once the.